The cash book is a key feature within Sage 200, as any transaction that involves cash via a receipt or payment, will be entered into the relevant cash book that is selected as part of the entry.

What is a Bank Reconciliation?

Bank reconciliations are seen as something that accountants do, but not everyone does them right, or fully understands why they are doing them. What you are actually doing is ensuring that all transactions on your bank statement have been entered in to Sage 200 correctly. But the key is to also ensure that the cash book balance matches the balance on the nominal code that the cash book is linked to. This is vital as it ensures that the transactions you have reconciled in the cash book are mirrored in the nominal ledger.

For all versions of Sage 200 up to the 2016 release, you should then perform a reconciliation on each cash book account. From the Sage 200c release in 2017, it is possible to enter bank feeds into Sage 200, direct from your bank, to assist with the reconciliation process.

How to Balance your Cash Book

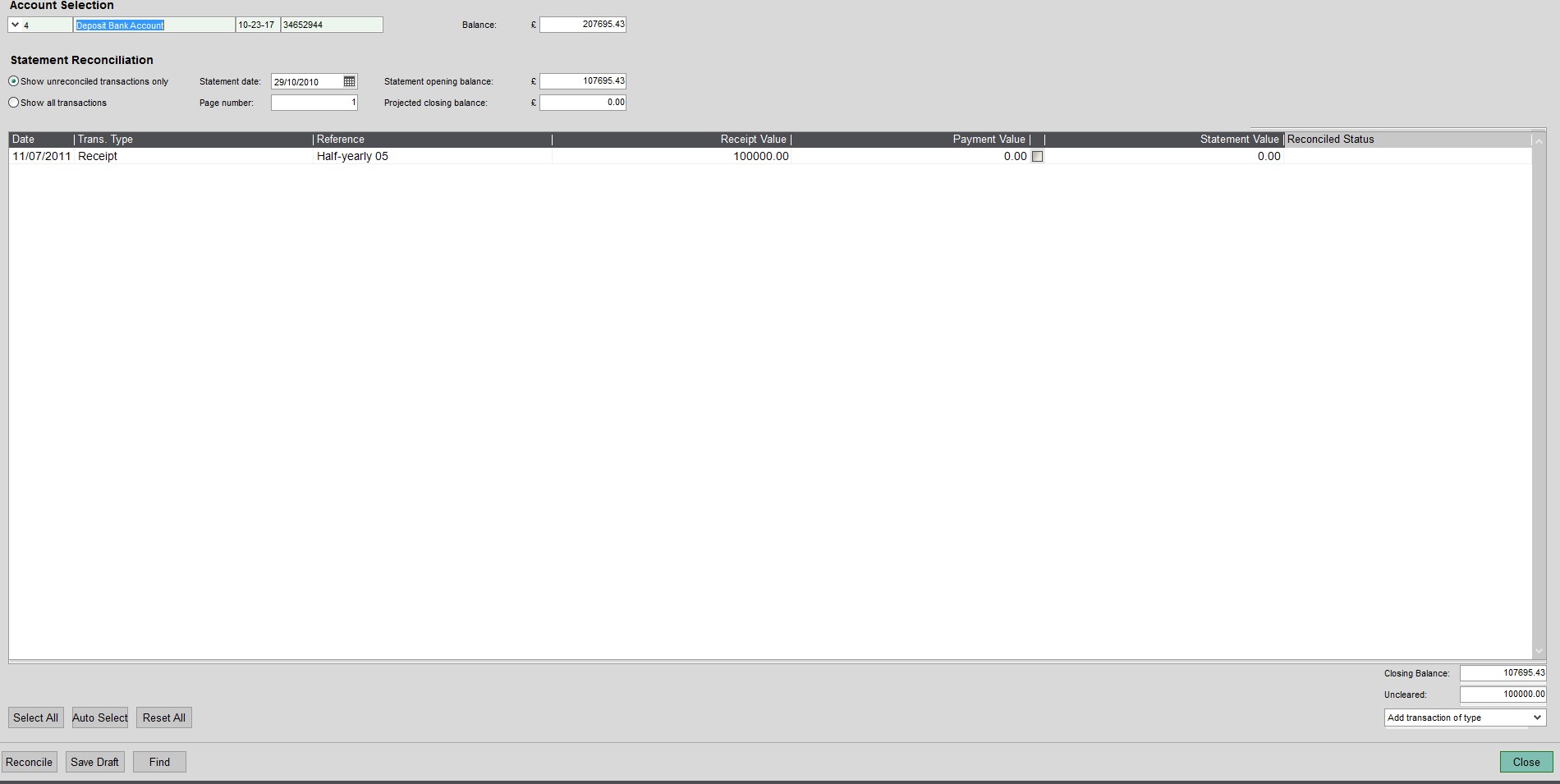

From the screenshot below, you can see a bank reconciliation taking place, and when this screen is saved, 2 reports will be produced, one listing the reconciled items as part of this save, and one reporting the items that are still unreconciled in the cash book. These are the items that have been entered into the cash book on Sage, but have not yet cleared the bank and appeared on the bank account.

If, as you are performing the bank reconciliation, you come across items on the statement that are not in Sage, you can add them via the transaction entry option at the bottom right of the screen.

You need to ensure the statement balance per Sage matches the statement balance per the bank statement.

The next reconciliation figure you need to agree is the cash book balance (this is on the top right of the screenshot), and this should balance to the Nominal Ledger balance for the relevant bank control account in the nominal ledger.

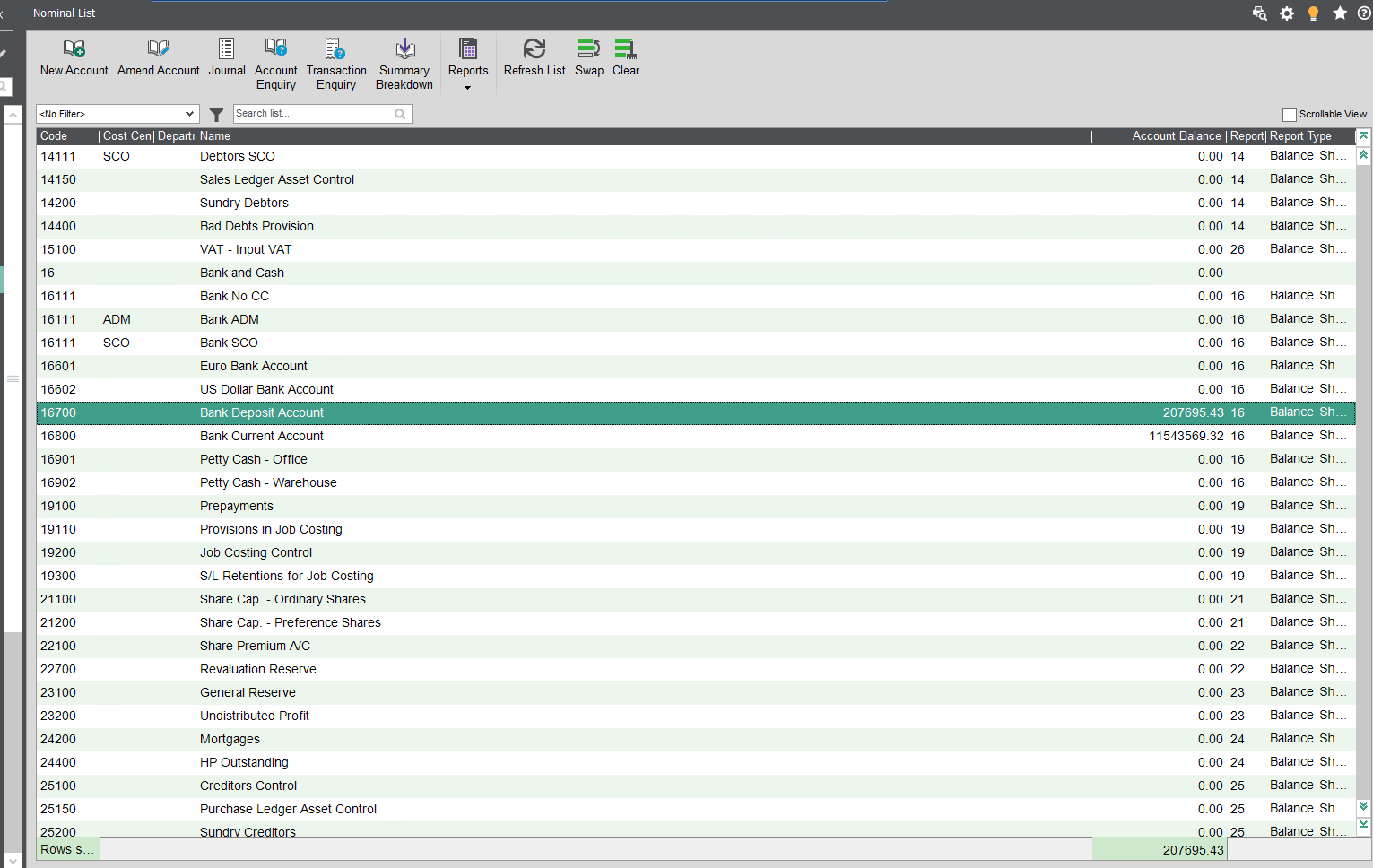

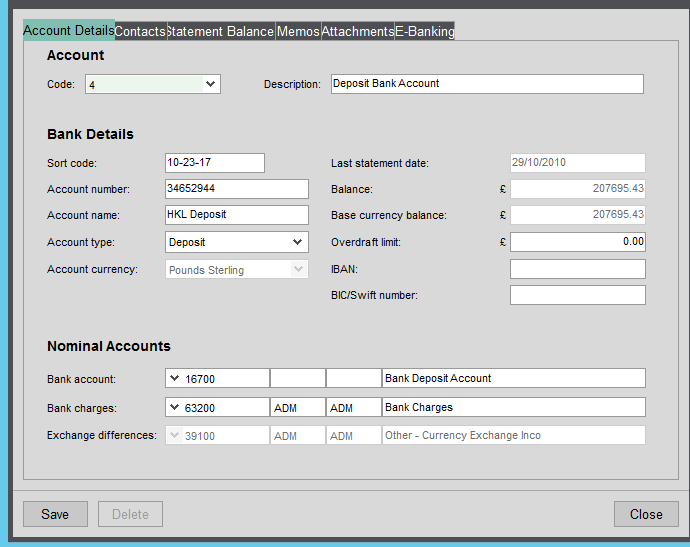

Below is how you know which code this is (see the Amend Account screen), and the Nominal Code List shows the Nominal balance as we have the setting ticked to show this balance for this nominal code. Any discrepancies should be identified, and this is an area that causes common questions from our customers.

The most common reasons are that a journal has been posted to the nominal account, as a journal will not be posted to the cash book, so would throw the 2 out of balance (you can prevent a journal being posted to any nominal account via the tickbox in the Amend Nominal Account screen), and it is possible that the cash book has transactions entered that are sat awaiting a period to be opened in the Nominal Ledger, so they are in the cash book balance, but not yet included in the nominal account balance. These can be identified by running a Nominal Ledger View Waiting Postings (Deferred) from within Nominal Ledger Reports.

Conclusion

That has been a brief outline of what the reconciliation means between both Sage and the bank statement, and the cash book module and the nominal module, and how to identify the most common reasons for discrepancies. But please do not hesitate to contact us if you have any further sage 200 training requirements, need help with Sage Intacct or need help with reconciliations that do not balance and we will be happy to assist.